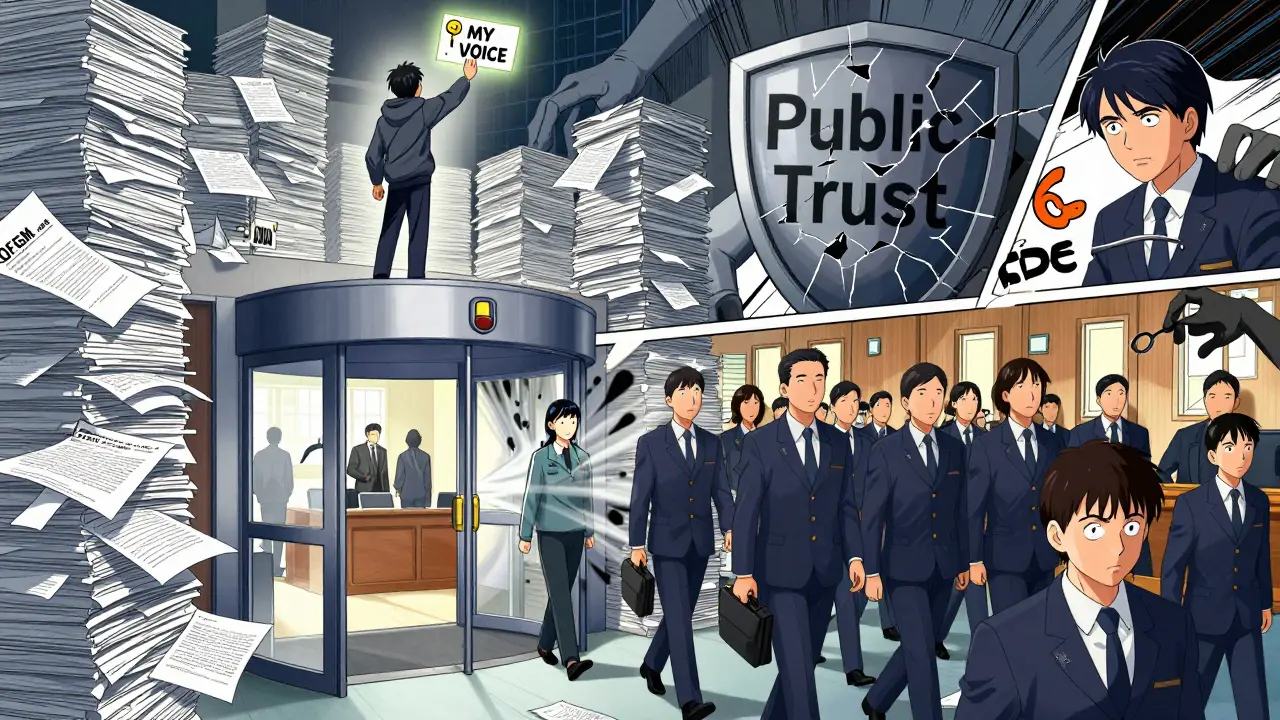

Imagine a safety inspector who used to work for the company they’re supposed to be checking. Now they’re giving it a clean bill of health - not because it’s safe, but because they’re planning to go back to work there next year. This isn’t a fictional scenario. It’s regulatory capture - and it’s happening right now in agencies meant to protect you.

What Regulatory Capture Really Means

Regulatory capture happens when the agencies created to protect the public end up serving the industries they’re supposed to regulate. It’s not always bribery or corruption. Often, it’s quieter: a regulator spends years talking to the same engineers, attending the same conferences, reading the same reports from the same companies. Over time, they start thinking like them. They begin to see industry concerns as their own. The public interest fades into the background.

This isn’t theoretical. In 2011, the Financial Crisis Inquiry Commission found that 87% of SEC staff who regulated Wall Street firms had personal or professional ties to those same firms. That’s not coincidence. It’s systemic. When regulators rely on the industry for technical data - because they don’t have the staff or expertise to verify it themselves - they become dependent. And dependence leads to deference.

The Two Main Ways Capture Happens

There are two primary paths to regulatory capture: materialist and cultural.

Materialist capture is about money and jobs. The revolving door is the clearest example. Between 2008 and 2018, 53% of senior U.S. Department of Defense officials left government and joined defense contractors within a year. That’s not just a career move - it’s a signal. Regulators know that if they’re too tough on Boeing or Lockheed Martin, they might never work in the industry again. So they ease up. The same pattern shows up in the FDA, the EPA, and the FCC. Former regulators become lobbyists. Former lobbyists become regulators. The line between public service and private gain disappears.

Cultural capture is more subtle. It’s when regulators stop seeing industry players as adversaries and start seeing them as colleagues. They adopt the same jargon. They believe the same arguments. They trust the same data. A 2021 study found agencies with formal industry advisory committees were 3.7 times more likely to adopt rules that favored those industries. Why? Because the regulators spent so much time listening to them, they started agreeing with them.

Real Cases, Real Costs

The sugar industry in the U.S. is a textbook example. The government imposes tariffs and quotas to protect 4,318 domestic sugar producers. The cost? $3.9 billion a year paid by consumers - about $33 per household. That’s not much for each person. But for those 4,318 companies, it’s $1.2 billion in extra profit. The public doesn’t organize. The industry does. And because the cost is spread thin while the benefit is concentrated, the industry wins.

In the UK, energy regulator OFGEM approved £17.8 billion in bill increases between 2015 and 2020 to fund grid upgrades. But the companies kept profit margins at 11.2% - way above the 6.8% limit. Consumers paid more. The companies made more. Regulators didn’t push back.

The FAA’s handling of the Boeing 737 MAX is another chilling case. The agency delegated 96% of safety reviews to Boeing employees. When the planes crashed, killing 346 people, the investigation revealed regulators had been relying on the manufacturer’s own safety assessments for years. That’s not oversight. That’s outsourcing accountability.

Why It Keeps Happening

George Stigler, the economist who first described regulatory capture in 1971, got it right: industries have a huge incentive to influence regulation. A single rule change can mean billions in profit. Consumers? Each person pays a few dollars extra. They don’t notice. They don’t care enough to fight back.

Industry groups spend 17.3 times more per person on lobbying than consumer groups. In the U.S., they spend 22.4 times more on political contributions. And it works. Between 2015 and 2022, 78% of proposed anti-capture laws failed. Why? Because the people pushing them don’t have the money, the access, or the political power.

Technical complexity helps too. Regulating cryptocurrency requires understanding 1,842 different technical protocols. No regulator can master all of them. So they turn to the industry for help. And the industry gives them the answers that make their business easier - not safer.

Who’s Fighting Back?

Some places are trying to fix this.

New Zealand introduced an independent review process for all new regulations. Between 2016 and 2022, the share of rules that favored industry dropped from 68% to 31%. Canada trained its regulators to limit industry meetings and increase public input. The result? Industry meetings got 27% shorter. Public consultations went up 43%.

The European Commission now requires at least 40% of members on advisory panels to be consumer advocates - not industry reps. The U.S. Federal Trade Commission launched a new Office of Regulatory Integrity in 2023 with a $23 million budget to track conflicts of interest and audit agency decisions.

And then there’s France’s Convention Citoyenne pour le Climat. Instead of letting energy companies shape climate policy, they randomly selected 150 citizens to debate and propose solutions. The result? Energy sector influence on final policy dropped by 52%.

What You Can Do

You might think this is too big for one person to change. But you’re part of the public that gets hurt when capture happens.

- Check your agency’s website. Most federal agencies list their advisory committee members. See how many are from industry versus consumer groups.

- Submit public comments during rulemaking. Most people don’t. That’s why industry comments dominate. Your voice matters - even if it’s just one.

- Support watchdog groups. Organizations like Public Citizen, the Center for Responsive Politics, and Corporate Europe Observatory track these issues. Donate. Volunteer. Share their reports.

- Ask your representatives: Are they pushing for stronger cooling-off periods? For mandatory disclosure of all industry contacts? For independent audits of regulatory decisions?

Regulatory capture doesn’t happen overnight. It’s built slowly - through quiet meetings, shared lunches, revolving doors, and the slow erosion of public trust. But it can be undone. Not by grand speeches or sweeping reforms. But by people paying attention. By demanding transparency. By refusing to accept that the system is broken - and that nothing can be done.

Frequently Asked Questions

Is regulatory capture the same as corruption?

No. Corruption involves illegal acts like bribery or kickbacks. Regulatory capture is often legal - it’s about influence, access, and relationships. A regulator might not take a bribe, but if they plan to join a company next year, they’ll likely soften their stance now. That’s capture, not crime - but it’s just as damaging.

Which industries are most prone to regulatory capture?

According to the World Bank, financial services have the highest capture rate at 67%, followed by energy (58%) and pharmaceuticals (52%). These industries are highly profitable, technically complex, and spend heavily on lobbying. They also have deep ties to government through the revolving door. The sugar industry, though smaller, is a classic case because its benefits are concentrated among a few players while costs are spread across millions of consumers.

How does the revolving door contribute to regulatory capture?

The revolving door creates a powerful incentive. Regulators know that being too strict could close off future job opportunities. Between 1990 and 2020, 92% of former SEC commissioners took jobs with regulated firms within 18 months. That’s not coincidence - it’s a career path. And when regulators are thinking about their next job, they’re not thinking about protecting the public.

Can technology make regulatory capture worse?

Absolutely. In 2023, MIT found that AI-powered lobbying - where bots generate 17,000 personalized regulatory comments per hour - increased industry influence by 34% in telecom rulemaking. Regulators can’t possibly read or verify all of them. The system gets flooded with industry-friendly noise, drowning out public input. This is digital capture: a new, scalable way to overwhelm the process.

Are there any countries doing this right?

Yes. Nordic countries like Denmark and Finland score among the lowest on the regulatory capture index, meaning less industry influence. New Zealand’s independent review process cut industry-favored rules by more than half. Canada’s training programs improved regulator independence. France’s citizen-led climate convention reduced energy sector influence by over half. These aren’t perfect, but they show that change is possible when institutions are designed to resist capture - not enable it.

Author

Mike Clayton

As a pharmaceutical expert, I am passionate about researching and developing new medications to improve people's lives. With my extensive knowledge in the field, I enjoy writing articles and sharing insights on various diseases and their treatments. My goal is to educate the public on the importance of understanding the medications they take and how they can contribute to their overall well-being. I am constantly striving to stay up-to-date with the latest advancements in pharmaceuticals and share that knowledge with others. Through my writing, I hope to bridge the gap between science and the general public, making complex topics more accessible and easy to understand.