When you pick up a prescription, you might not realize your insurance company already made a decision for you-whether you get the brand-name drug or the cheaper generic version. And that decision isn’t random. It’s built into the insurance formulary, a hidden rulebook that controls what you pay, what you get, and sometimes, whether you get it at all.

Why Generics Cost So Much Less

Generic drugs aren’t knockoffs. They’re exact copies of brand-name drugs in terms of active ingredients, strength, dosage, and how they work in your body. The FDA requires them to meet the same safety and effectiveness standards. So why does a generic version of Lipitor cost $4 while the brand costs $85? The difference comes down to money spent before the drug even hits the shelf. Brand-name companies spend years and hundreds of millions developing a new drug, running clinical trials, and marketing it. Once the patent runs out, other companies can make the same drug without those upfront costs. They don’t need to repeat expensive studies. The result? Generics are 80% to 85% cheaper. That’s not a marketing trick-it’s basic economics.How Insurance Formularies Decide What You Pay

Most insurance plans use a tiered system to organize drugs. Think of it like a price ladder:- Tier 1: Generics. Usually $5-$15 for a 30-day supply.

- Tier 2: Preferred brand-name drugs. Copays around $40-$60.

- Tier 3: Non-preferred brand-name drugs. $70-$100 or more.

- Tier 4: Specialty drugs. Often coinsurance-25% to 33% of the total cost.

When the System Gets in the Way

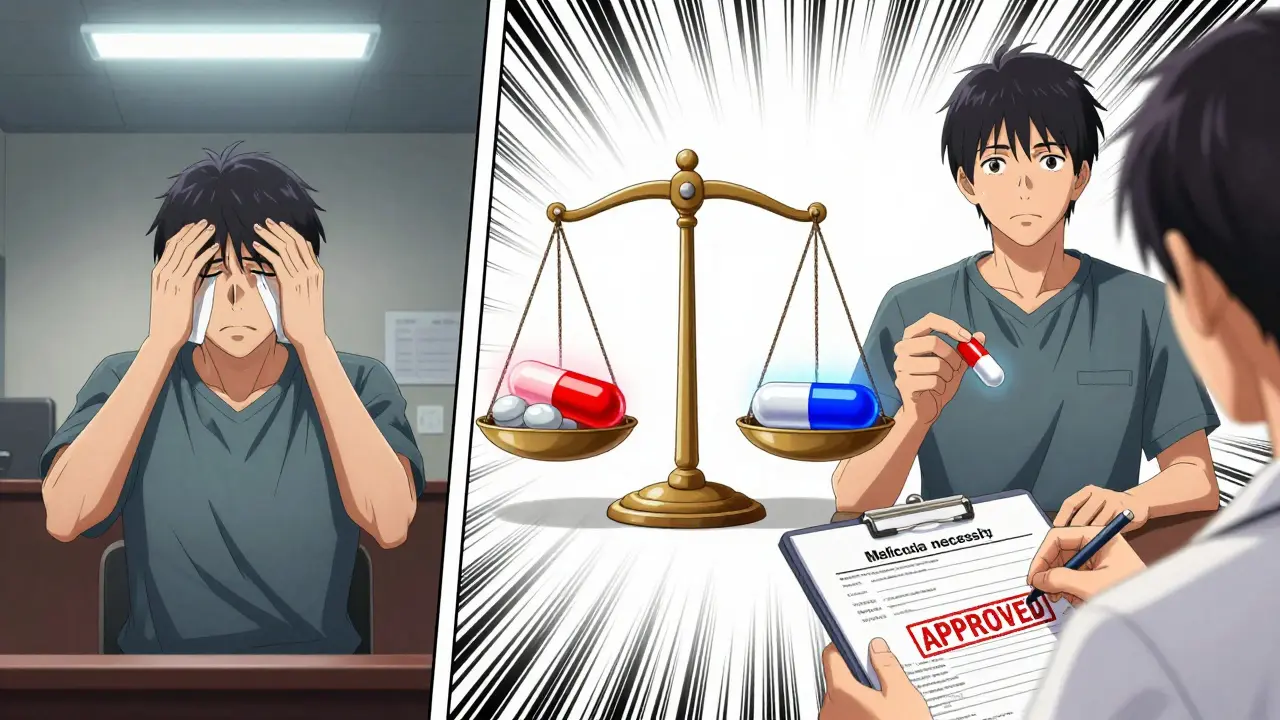

For most people, this system works fine. But not everyone responds the same way to a generic drug. Some patients report side effects, reduced effectiveness, or new symptoms after switching from brand to generic-even though the active ingredient is identical. That’s because generics can have different inactive ingredients: fillers, dyes, coatings. For most people, those don’t matter. But for someone with a rare allergy, or a condition like epilepsy or thyroid disease, even small changes can cause problems. A 2022 JAMA Neurology study found that 12.3% of patients switching from brand to generic antiepileptic drugs had more seizures. That’s not a fluke-it’s a real risk. That’s why 42 states let doctors declare a “medical necessity” exception. If your doctor writes that your condition requires the brand-name version, your insurance has to cover it. But getting that approval isn’t easy. You might need to try and fail on two or three generics first. That can mean weeks of unstable symptoms while you wait for paperwork to clear.

What Medicare and Medicaid Do Differently

Medicare Part D plans are even stricter. By law, pharmacists must substitute generics unless the doctor says no. In 2022, 91% of all Part D prescriptions were generics. That’s great for savings-Medicare saved billions-but it’s tough on patients who genuinely need the brand. Medicaid works differently. It pays the lowest price any private insurer pays for a drug-called the “best price.” That means generics get reimbursed at rock-bottom rates, often 87% lower than brand-name drugs. But Medicaid patients rarely face prior authorizations. The system is designed to get people the cheapest effective option, fast.What You Can Do When Coverage Gets Stuck

If your insurance denies coverage for a brand-name drug you need, here’s what actually works:- Ask your doctor to write “dispense as written” on the prescription. This stops automatic substitution.

- Request a prior authorization. Your doctor fills out a form explaining why the generic didn’t work or caused side effects.

- Submit lab results or symptom logs. If you had a seizure, a spike in blood pressure, or worsening depression after switching, document it.

- Appeal. Most denials get reversed on appeal if you have medical evidence.

- Check for patient assistance programs. Brand-name manufacturers often offer copay cards that cut your cost to $0-but only if you’re privately insured. Medicare and Medicaid patients can’t use them.

Why Some Generics Are Treated Better Than Others

Not all generics are created equal in the eyes of insurers. “Authorized generics” are made by the original brand-name company but sold under a generic label. These are often placed on lower tiers than third-party generics because insurers trust them more. In 2023, 46% of all generic prescriptions were authorized generics. That’s not a coincidence. Insurers know they’re identical to the brand. So they’re more likely to cover them without extra hoops. Meanwhile, complex generics-like inhalers, injectables, or topical creams-are harder to copy exactly. So insurers treat them more like brand-name drugs. You’ll often need prior authorization even for these generics.What’s Changing in 2025 and Beyond

New rules are coming. Starting in 2025, the FDA will require clearer labeling on generics showing their therapeutic equivalence rating. That means pharmacists and insurers will know exactly how interchangeable a drug really is. Medicare’s 2024 rules will force insurers to approve prior authorizations for brand-name drugs within 72 hours-down from the current range of same-day to two weeks. That’s a big win for patients stuck waiting. And with more specialty drugs hitting the market-53% of new FDA approvals in 2022 were specialty meds-there’s less room for generics. That means insurers will shift focus to biosimilars (similar to generics but for biologic drugs), which are just starting to enter the market.Real Stories Behind the Numbers

On Reddit, a user shared how they paid $85 for Crestor after their insurance denied coverage for a medical necessity exception. Their doctor had documented heart issues linked to the generic version. It took three appeals and two weeks to get approved. On Drugs.com, a thread with over 2,800 comments details how switching from brand-name Wellbutrin XL to a generic caused severe anxiety and insomnia. Many users say they had to go back to the brand-sometimes paying out of pocket-to feel normal again. A Kaiser Family Foundation survey found that 34% of insured patients didn’t understand their plan’s generic rules. And 19% skipped filling prescriptions because they feared a surprise bill. The system saves billions. But it doesn’t always save people.Are generic drugs really as effective as brand-name drugs?

Yes, for most people. The FDA requires generics to have the same active ingredient, strength, dosage form, and performance as the brand-name version. They’re tested to ensure they work the same way in the body. But for a small group of patients-especially those on narrow therapeutic index drugs like warfarin, levothyroxine, or phenytoin-switching can cause side effects or reduced effectiveness due to differences in inactive ingredients.

Why does my insurance make me try generics first?

Insurance companies use step therapy to control costs. Since generics cost 80-85% less, they’re the logical first choice. If you don’t respond well, you can appeal for the brand-name drug. But you usually need to document at least two failed trials with generics before they’ll approve the brand. This can delay treatment by 6-8 weeks.

Can I just pay out of pocket for the brand-name drug?

Yes, but you won’t get credit toward your deductible or out-of-pocket maximum if you skip the generic. Your insurance won’t count it toward your coverage limits. That means you’ll still be in the coverage gap longer. Only pay out of pocket if the brand is truly necessary and you can’t get coverage through an exception.

What’s the difference between a generic and an authorized generic?

An authorized generic is made by the original brand-name manufacturer but sold under a generic label. It’s chemically identical to the brand. Third-party generics are made by other companies. Insurers often favor authorized generics because they’re more predictable and have fewer reports of side effects. In 2023, nearly half of all generic prescriptions were authorized generics.

Do Medicare and Medicaid cover generics differently?

Yes. Medicare Part D requires pharmacists to substitute generics unless the doctor says no. Medicaid pays the lowest price available to any private insurer, making generics extremely cheap for the program. But Medicaid patients rarely face prior authorizations. Medicare patients can’t use manufacturer copay cards, while commercial insurance patients often can.

How do I know if my drug has a generic version?

Check your insurance plan’s formulary online, or ask your pharmacist. You can also search the FDA’s Orange Book, which lists approved generic equivalents. If your drug’s patent expired more than 5 years ago, a generic almost certainly exists. Newer drugs (under 10 years old) may still be brand-only.

Why do some people have bad reactions to generics?

The active ingredient is the same, but inactive ingredients-like dyes, fillers, or coatings-can vary. For most people, this doesn’t matter. But for those with sensitivities, allergies, or conditions like epilepsy, thyroid disease, or depression, these differences can affect how the drug is absorbed or how the body reacts. Some patients report nausea, dizziness, or loss of symptom control after switching.

Can my doctor force my insurance to cover the brand-name drug?

Not directly, but they can request a medical necessity exception. If they document that the generic caused side effects, failed to control symptoms, or that you’ve tried and failed on multiple generics, the insurer must review it. Approval isn’t guaranteed, but with solid documentation, most denials can be overturned on appeal.

Author

Mike Clayton

As a pharmaceutical expert, I am passionate about researching and developing new medications to improve people's lives. With my extensive knowledge in the field, I enjoy writing articles and sharing insights on various diseases and their treatments. My goal is to educate the public on the importance of understanding the medications they take and how they can contribute to their overall well-being. I am constantly striving to stay up-to-date with the latest advancements in pharmaceuticals and share that knowledge with others. Through my writing, I hope to bridge the gap between science and the general public, making complex topics more accessible and easy to understand.